- 经济管理

- 行业报告

- 企业管理与咨询报告

移动支付报告2015(英文 20 页)

THE MOBILE PAYMENTS REPORT: Forecasts, user trends, and the companies vying to dominate mobile payments

John Heggestuen | May 19, 2015

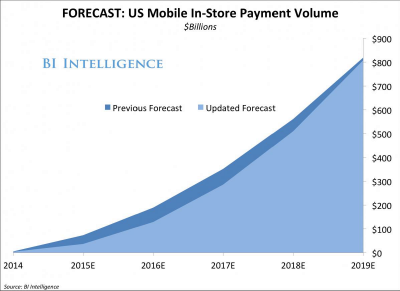

In our latest US in-store mobile payments forecast, we find that mobile payment volume will reach $37 billion this

year. This is about half our previous estimate of $74 billion in mobile payment volume in 2015, and the downward revision is primarily the result of later-than-expected launches of major mobile wallets from big tech players.

But by the end of the forecast period in 2019, we expect volume to reach $808 billion, or about 99% of the old estimate. Our forecast is still one of the largest in the industry, and we think mobile payments will catch on faster than other research firms suggest: Mobile payment capability is either already offered or about to be implemented at merchants accounting for a huge chunk of US payment volume.

The number of people who make a mobile payment at least once a year will grow from nearly 8% of the US consumer population in 2014 to 65% by 2019. The growth in mobile payment users will largely be driven by mobile wallet initiatives from Apple,Samsung, and Google. When these are in place, 90% of the forthcoming smartphones in the US will come with mobile wallets preinstalled.

Samsung Pay will be a huge driver of mobile payment volume. Unlike Apple Pay, when Samsung Pay launches it will be compatible at virtually every payment terminal in the US, thanks to the company's acquisition of LoopPay. This will make it easier for early adopters to make a habit of paying with their phone.

The sheer number of high-profile mobile wallets available or in the works from Apple Pay, Samsung Pay, CurrentC, Google Wallet, and others will drive mobile payment adoption as well. This will largely be the result of competitive pressure building between the companies and the bandwagon effect. Adoption will be self-reinforcing — the more consumers and retailers that use or offer mobile in-store payments, the more the behavior will catch on among others.

But even as mobile payments competition increases, it's important to note that the big tech companies aren't all after the same objective. For Apple, introducing Apple Pay is about continuing to improve the mobile experience, whereas for PayPal the goal is a greater share of retail dollars. For Google, meanwhile, it's about gaining further insight into consumer behavior to boost ad revenue.

[报告关键词]: 移动支付×所属专题: 金融投资下载《移动支付报告2015(英文 20 页)》需 20点,包月包季包年会员(点此注册)免费下载。

一、非注册用户快速自助下载两步完成:1 注册(点此),2 购点卡(点此) 充值(点此)自主下载

二、非注册用户直接付款(点此付款),付款后短信(18121118831或加微信)告知题目或者Email,我们通过邮件发给您。需要帮助?专题跟踪研究报告

企业出海 新质生产力 低空经济 生成式AI 工业互联网 数字藏品 动力电池 ESG 数字化转型 机械零部件 氢能 碳中和 区块链 元宇宙 建筑 矿产 安永 数字货币 新基建 日化 案例分析 毕马威 贝恩咨询 普华永道 波士顿 罗兰贝格 德勤咨询 埃森哲 麦肯锡 电商 金融科技 人工智能 物联网 互联网金融 大数据 3D打印 食品饮料 家电行业 零售连锁 新能源 商业地产 快递行业 机械设备 汽车 核电 电子产业 电力行业 新兴产业 纺织服装 医药生物 广告传媒 金融投资 航空 旅游 酒业 能源 有色金属 通信 石油化工 物流供应链 房地产 可行性报告 PPP 商业计划书 五力分析 并购重组 发展战略 SWOT 产业链 钻石模型 价值链 PEST 人力资源 面板模型 stata 精华推荐 供应链金融 互联网+ 机器人 O2O 教育培训 论文资料查找 写作修改服务 EMBA论文写作 硕士论文 本科论文 论文写作每年为数千个企事业和个人提供专业化服务;量身定制你需要的行业分析的资料和报告

相信我们!企业客户遍及全球,提供政府部门、生产制造企业、物流企业、快消品行业专业化咨询服务;个人客户可以提供各类经济管理资料、商业计划、PPT、MBA/EMBA论文指导等。

点此填写您的需求15+年的经验,值得信赖

可以QQ联系我们:896161733;也可以电话:18121118831