- 经济管理

- 行业报告

- 企业管理与咨询报告

IMF:全球金融稳定报告(英文 132 页)

Global Financial Stability Report

October 2016

CONTENTS

Assumptions and Conventions vi

Further Information and Data vii

Preface viii

Executive Summary ix

IMF Executive Board Discussion Summary xiii

Chapter 1 Financial Stability Challenges in a Low-Growth, Low-Rate Era 1

Financial Stability Overview 1

Medium-Term Risks Rising 6

Emerging Market Economies: A Smooth Deleveraging? 27

Global Stability Challenges in the New Era 38

Box 1.1. Impact of Brexit 41

Box 1.2. The Basel Committee Agenda: Achieving Certainty without Compromising Integrity 44

Annex 1.1. Financial Stagnation and Protectionism Scenario 45

References 48

Chapter 2 Monetary Policy and the Rise of Nonbank Finance 49

Summary 49

Introduction 50

Trends in the Transmission of Monetary Policy 52

Channels of Monetary Policy Transmission 53

Empirical Evidence on the Transmission of Monetary Policy 58

Policy Discussion 66

Conclusions and Policy Recommendations 67

Box 2.1. Monetary Policy and the Stock Returns of Banks and Nonbanks 69

Box 2.2. Exchange Rate Volatility, Monetary Policy, and Nonbanks 71

Annex 2.1. Aggregate Vector Autoregression Analysis 73

Annex 2.2. Microanalysis of the Behavior of Financial Firms 75

Annex 2.3. Microanalysis of Borrower Behavior 76

References 78

Chapter 3 Corporate Governance, Investor Protection, and Financial Stability in Emerging Markets 81

Summary 81

Introduction 82

Nexus between Corporate Governance, Investor Protection, and Financial Stability 85

The Evolving Nature of Corporate Governance and Investor Protection 88

Corporate Governance, Investor Protection, and Financial Stability 93

Conclusions and Policy Implications 101

Box 3.1. Examples of Corporate Governance Reforms in Selected Emerging Market Economies 103

Box 3.2. Strengthening Corporate Governance for State-Owned Enterprises in China 104

Annex 3.1. Emerging Market Corporate Fundamentals and Governance 106

Annex 3.2. Analysis of Firm-Level Stock Price Comovement and Crash Risk 106

Annex 3.3. Estimating the Impact of Global Financial Shocks on Firm Equity Returns 108

Annex 3.4. Data Sources and Country Coverage 109

References 112

Tables

Table 1.1.1 Brexit Implications for the U.K. Financial Sector 42

Annex Table 1.1.1. Financial Stagnation and Protectionism Scenario, Assumptions 46

Table 3.1. Firm-Level Governance and Firm Characteristics 92

Table 3.2. Corporate Governance, Investor Protection, and Capital Market Development 94

Annex Table 3.1.1. Firm Governance and Fundamentals: Selected Regressions 107

Annex Table 3.2.1. Firm-Level Stock Price Comovement and Crash Risk 108

Annex Table 3.3.1. Global Financial Shocks and Firm Equity Returns 109

Annex Table 3.4.1. Data Sources 110

Figures

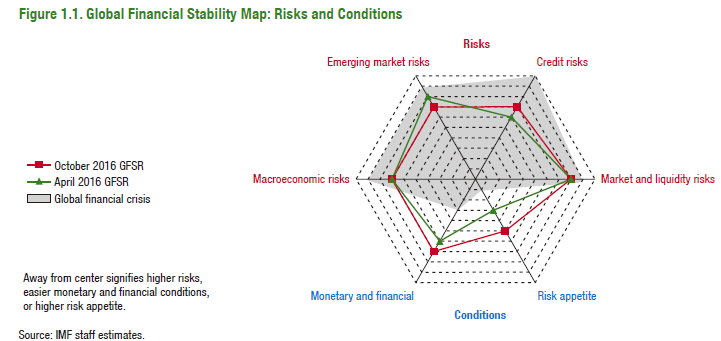

Figure 1.1. Global Financial Stability Map: Risks and Conditions 2

Figure 1.2. Global Financial Stability Map: Assessment of Risks and Conditions 3

Figure 1.3. Brexit’s Impact on Financial Markets 4

Figure 1.4. Decomposition of Equity Market Performance 5

Figure 1.5. Policy Uncertainty 6

Figure 1.6. Global Growth Momentum and Interest Rates 7

Figure 1.7. Sovereign Bond Yields and Term Premiums in Advanced Economies 9

Figure 1.8. Drivers of Government Bond Yields 10

Figure 1.9. Effects on Credit Growth of Shocks to Equity Prices 11

Figure 1.10. Developed and Emerging Market Economy Banks: Capital and Liquidity Indicators 12

Figure 1.11. Price-to-Book and Return on Equity Decomposition, 2006–15 13

Figure 1.12. Advanced Economies: Trends in Bank Profitability 14

Figure 1.13. Bank Performance in a “Cyclical Recovery” Scenario, by Region 16

Figure 1.14. Stylized Net Capital Impact of Nonperforming Loan Disposal at Euro Area Banks 17

Figure 1.15. European and U.S. Banks—Operating Efficiency and Cost Rationalization 18

Figure 1.16. European Banks’ Elevated Cost of Funding 20

Figure 1.17. European Bank Profitability in a “Structural Reform” Scenario 21

Figure 1.18. Japanese Banks and Foreign Exchange Funding 22

Figure 1.19. Low Interest Rates and Insurance Companies 25

Figure 1.20. U.S. Pension Fund Discount Rate 26

Figure 1.21. Pension Funding Shortfalls in the United States and the United Kingdom 27

Figure 1.22. Portfolio Flows to Emerging Market Economies and Asset Prices 29

Figure 1.23. Corporate Borrowing: Stabilized, but at a High Level 30

Figure 1.24. Scenarios for Deleveraging in Emerging Market Firms and Default Rates 32

Figure 1.25. Sensitivity of Emerging Market Economy Assets to Global Policy Uncertainty 34

Figure 1.26. China: Credit Overhang and Shadow Credit 36

Figure 1.27. China: Bank Linkages to the Structured Investment Complex 37

Figure 1.28. Financial Stagnation and Protectionism Scenario: Simulated Peak Effects 39

Figure 1.1.1. Brexit Implications for the United Kingdom 43

Figure 1.1.2. Brexit Impact on the U.K. Commercial Real Estate Markets 43

Annex Figure 1.1.1. Financial Stagnation and Protectionism Scenario, Aggregated Simulated Paths 47

Figure 2.1. The Relative Importance of Nonbank Financial Intermediaries 51

Figure 2.2. Trends in the Transmission of Monetary Policy 53

Figure 2.3. Transmission of Monetary Policy through the Reaction of Financial Intermediaries 54

Figure 2.4. Marked-to-Market Assets by Sector 56

Figure 2.5. Value at Risk in Risk Management by Asset Class and Year 58

Figure 2.6. Transmission of Monetary Policy and Size of Nonbank Financial Sector 59

Figure 2.7. Response to a Monetary Policy Contraction 60

Figure 2.8. Risk Taking and Monetary Policy in the United States 61

Figure 2.9. Monetary Policy and Total Assets Owned by Financial Intermediaries 63

Figure 2.10. Bank Regulation, Monetary Policy, and Total Assets Owned by Financial Institutions 64

Figure 2.11. Risk Taking by Mutual Funds and Monetary Policy 64

Figure 2.12. Bond Finance around the World 65

Figure 2.13. Bond Financing and Monetary Policy 66

Figure 2.1.1. Stock Price Responses to Unconventional Monetary Policy 69

Figure 2.2.1. Sensitivity of Financial Firms to Exchange Rate Changes, 1995–2016 71

Figure 2.2.2. Foreign Currency Liabilities of Banks and Nonbanks, 2001–14 71

Annex Figure 2.1.1. Trends in the Transmission of Monetary Policy—Robustness 73

Annex Figure 2.2.1. Summary Statistics 75

Figure 3.1. Corporate Governance and Equity Returns 82

Figure 3.2. Corporate Governance and Volatility of Stock Market Returns in Emerging

Market Economies 83

Figure 3.3. Ownership Structure and Closely Held Shares 86

Figure 3.4. Minority Shareholder Protection 89

Figure 3.5. Country-Level Corporate Governance and Investor Protection 90

Figure 3.6. Emerging Market Firm-Level Governance Index 91

Figure 3.7. Corporate Governance and Firm-Level Valuation 93

Figure 3.8. Firm-Level Governance and Valuation 94

Figure 3.9. Corporate Governance and Market Liquidity 95

Figure 3.10. Stock Return Comovement 96

Figure 3.11. Stock Market Comovement (R 2) over Time 96

Figure 3.12. Crash Risk 97

Figure 3.13. Event Study: Firm-Level Governance and Equity Returns 98

Figure 3.14. Impact of Global Financial Shocks on Equity Returns 99

Figure 3.15. Corporate Governance and Selected Balance Sheet Indicators 99

Figure 3.16. Firm-Level Governance and the Bond Market 100

Figure 3.17. Firm-Level Governance and Solvency 101

Figure 3.18. Country-Level and Firm-Level Governance and Short-Term Debt 101

Figure 3.2.1. Selected Emerging Market Economies: State-Owned Enterprises 104

Figure 3.2.2. Leverage and Equity Price Comovement of State-Owned Enterprises in China 105

[报告关键词]: 金融×下载《IMF:全球金融稳定报告(英文 132 页)》需 50点,包月包季包年会员(点此注册)免费下载。

一、非注册用户快速自助下载两步完成:1 注册(点此),2 购点卡(点此) 充值(点此)自主下载

二、非注册用户直接付款(点此付款),付款后短信(18121118831或加微信)告知题目或者Email,我们通过邮件发给您。需要帮助?专题跟踪研究报告

企业出海 新质生产力 低空经济 生成式AI 工业互联网 数字藏品 动力电池 ESG 数字化转型 机械零部件 氢能 碳中和 区块链 元宇宙 建筑 矿产 安永 数字货币 新基建 日化 案例分析 毕马威 贝恩咨询 普华永道 波士顿 罗兰贝格 德勤咨询 埃森哲 麦肯锡 电商 金融科技 人工智能 物联网 互联网金融 大数据 3D打印 食品饮料 家电行业 零售连锁 新能源 商业地产 快递行业 机械设备 汽车 核电 电子产业 电力行业 新兴产业 纺织服装 医药生物 广告传媒 金融投资 航空 旅游 酒业 能源 有色金属 通信 石油化工 物流供应链 房地产 可行性报告 PPP 商业计划书 五力分析 并购重组 发展战略 SWOT 产业链 钻石模型 价值链 PEST 人力资源 面板模型 stata 精华推荐 供应链金融 互联网+ 机器人 O2O 教育培训 论文资料查找 写作修改服务 EMBA论文写作 硕士论文 本科论文 论文写作每年为数千个企事业和个人提供专业化服务;量身定制你需要的研究报告的资料和报告

相信我们!企业客户遍及全球,提供政府部门、生产制造企业、物流企业、快消品行业专业化咨询服务;个人客户可以提供各类经济管理资料、商业计划、PPT、MBA/EMBA论文指导等。

点此填写您的需求15+年的经验,值得信赖

可以QQ联系我们:896161733;也可以电话:18121118831