- 经济管理

- 行业报告

- 企业管理与咨询报告

波士顿: 2024年全球资产管理报告 ( 英文 31页)

2023年,全球资产管理行业的资产规模增至近120万亿美元,扭转了前一年的下降趋势。然而,资产管理公司的增长面临着各种挑战。投资者正被吸引到被动管理型基金和其他收费较低的产品上,尽管资产管理公司的成本在上升。他们创造新产品以区别于竞争对手的努力在很大程度上没有达到目标,投资者主要坚持使用具有可靠业绩记录的成熟产品。从历史上看,由于收入增长在很大程度上受到市场升值的推动,该行业能够经受住这些压力。然而,在未来几年,市场升值预计将放缓,给该行业带来进一步的挑战。

面对这些压力,资产管理公司将需要重新思考其运营方式,以保持过去几年的增长和盈利能力。最可行的方法是使用我们称之为3P的方法:生产力,个性化和私人市场。资产管理公司应该提高生产力,个性化客户参与,并扩展到私人市场。

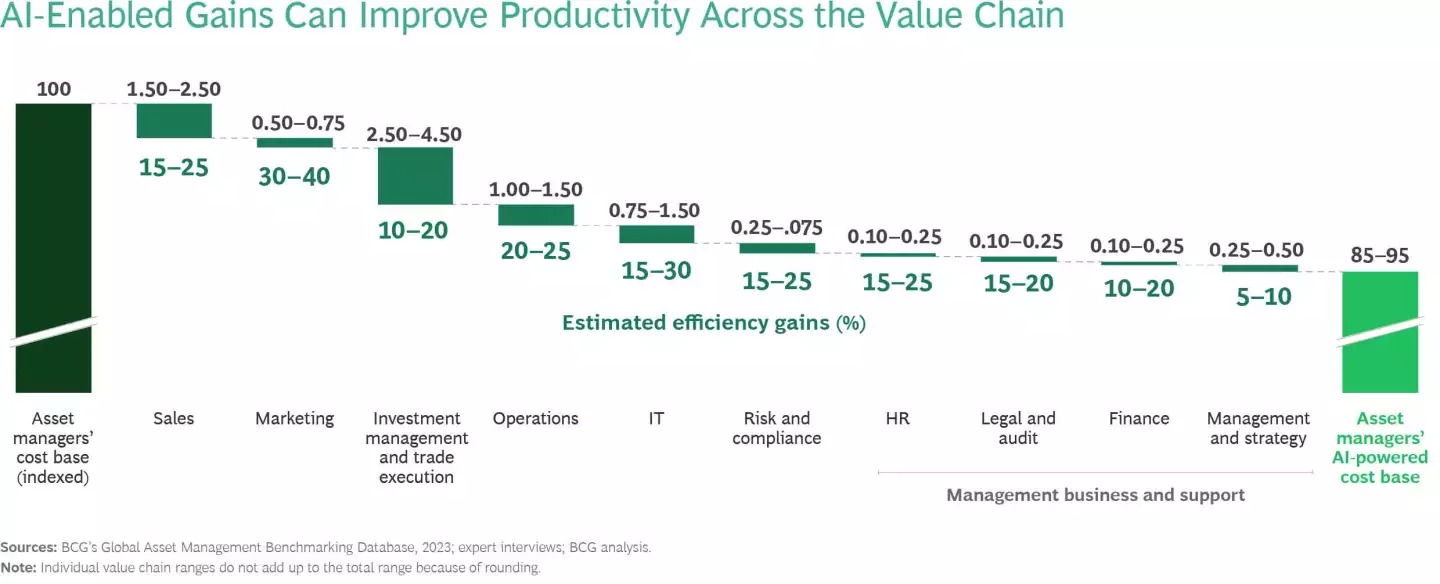

随着人工智能(AI)技术革命的发展势头,资产管理公司有机会投资AI,并将其整合到其运营中,以加强3P战略。人工智能可以通过改善决策和运营效率来提高生产力。它可以用来大规模创建和管理个性化的产品组合,并定制客户体验。人工智能可以提高私人市场交易团队的效率,并提高他们推动价值创造的能力。在采用人工智能来促进这些关键举措时,资产管理人员应该将技术可能性视为其组织的转型工具。

作为今年报告的一部分,我们对管理资产总额超过15万亿美元的资产管理公司进行了调查,以收集他们对人工智能在其业务中的作用的看法。绝大多数受访者希望在短期内看到重大或变革性的变化,三分之二的受访者计划在今年推出至少一个生成式AI(GenAI)用例,或者已经在扩展一个或多个用例。

在投资人工智能方面,等待不是一种选择。这项技术正在迅速发展,没有开始这一旅程的资产管理公司现在有可能被抛在后面。

The global asset management industry’s assets rose to nearly $120 trillion in 2023, reverting from a decline the year before. However, asset managers are facing a variety of challenges to their growth. Investors are gravitating to passively managed funds and other products that have lower fees even as asset managers’ costs increase. Their efforts to create new products that would differentiate them from competitors have largely fallen short, with investors sticking mostly to established products with reliable track records. Historically, the industry has been able to weather these pressures thanks to revenue growth that has been largely driven by market appreciation. In the years ahead, however, market appreciation is expected to slow, creating further challenges to the industry.

In the face of these pressures, asset managers will need to rethink the way they operate in order to maintain the growth and profitability of past years. The most viable way forward is by using an approach that we call the three Ps: productivity, personalization, and private markets. Asset managers should increase productivity, personalize customer engagement, and expand into private markets.

As the artificial intelligence (AI) technological revolution gathers momentum, asset managers have an opportunity to invest in AI and integrate it into their operations in ways that can enhance a three Ps strategy. AI can boost productivity by enabling improved decision making and operational efficiencies. (See the exhibit.) It can be leveraged to create and manage personalized portfolios at scale and to tailor the customer experience. And AI can enhance the efficiency of deal teams in private markets and boost their ability to drive value creation. In adopting AI to facilitate these key moves, asset managers should view the technological possibilities as transformational tools for their organization.

As part of this year’s report, we surveyed asset managers with collectively more than $15 trillion in assets under management to gather their views on the role of AI in their business. The vast majority of survey respondents expect to see significant or transformative changes in the short term, and two-thirds either have plans to roll out at least one generative AI (GenAI) use case this year or are already scaling one or more use cases.

Waiting is not an option when it comes to investing in AI. The technology is rapidly developing, and asset managers that do not start their journey now risk being left behind.

[报告关键词]: 资产管理×下载《波士顿: 2024年全球资产管理报告 ( 英文 31页)》需 50点,包月包季包年会员(点此注册)免费下载。

一、非注册用户快速自助下载两步完成:1 注册(点此),2 购点卡(点此) 充值(点此)自主下载

二、非注册用户直接付款(点此付款),付款后短信(18121118831或加微信)告知题目或者Email,我们通过邮件发给您。需要帮助?专题跟踪研究报告

企业出海 新质生产力 低空经济 生成式AI 工业互联网 数字藏品 动力电池 ESG 数字化转型 机械零部件 氢能 碳中和 区块链 元宇宙 建筑 矿产 安永 数字货币 新基建 日化 案例分析 毕马威 贝恩咨询 普华永道 波士顿 罗兰贝格 德勤咨询 埃森哲 麦肯锡 电商 金融科技 人工智能 物联网 互联网金融 大数据 3D打印 食品饮料 家电行业 零售连锁 新能源 商业地产 快递行业 机械设备 汽车 核电 电子产业 电力行业 新兴产业 纺织服装 医药生物 广告传媒 金融投资 航空 旅游 酒业 能源 有色金属 通信 石油化工 物流供应链 房地产 可行性报告 PPP 商业计划书 五力分析 并购重组 发展战略 SWOT 产业链 钻石模型 价值链 PEST 人力资源 面板模型 stata 精华推荐 供应链金融 互联网+ 机器人 O2O 教育培训 论文资料查找 写作修改服务 EMBA论文写作 硕士论文 本科论文 论文写作每年为数千个企事业和个人提供专业化服务;量身定制你需要的金融投资的资料和报告

相信我们!企业客户遍及全球,提供政府部门、生产制造企业、物流企业、快消品行业专业化咨询服务;个人客户可以提供各类经济管理资料、商业计划、PPT、MBA/EMBA论文指导等。

点此填写您的需求15+年的经验,值得信赖

可以QQ联系我们:896161733;也可以电话:18121118831